If the goal is to get your loan paid off faster and to save money in the process, no-cost refinancing might not be the best solution. You generally end up paying slightly less if you pay the fees up front, since sometimes you end up repaying them with interest if they're amortized with the rest of your loan. No-cost means that the fees aren't upfront, but either built into your monthly payments or exchanged for a higher interest rate. You also need to consider how no-cost refinancing affects amortization. When considering whether to refinance, you have to figure out whether the savings you'll get will be more than the amount you have to pay to refinance. You also have to pay several fees, which depend on the state and lender. When you refinance a loan, either to get a lower interest rate or to change the loan's time period, you have to pay a small percentage of the amount of principal you have left. It may increase more than you can afford, which is what prevents people from refinancing to a shorter-term loan. This accelerates your payments and reduces your interest, with one serious drawback: Your monthly payment increases. Refinancing is how you change the schedule on which you're required to pay off the loan, say from 30 years to 20 or even 15. If your loan is set on a 30-year time period, as are most mortgages, one way to use amortization to your advantage is to refinance your loan. A shorter payment period means larger monthly payments, but overall you pay less interest. A longer or shorter payment schedule would change how much interest in total you will owe on the loan. The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period.

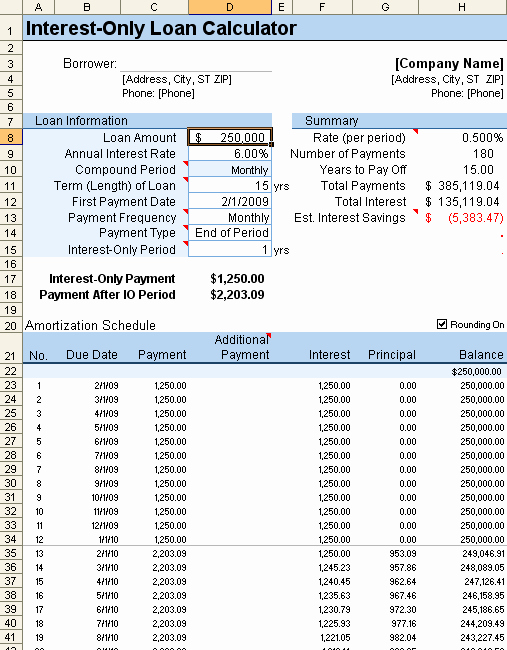

One significant factor of amortization is time. Initial monthly payments will go mostly to interest, while later ones are mostly principal. How much of that monthly payment goes to interest and how much goes to repaying the principal changes as you pay back the loan. To keep loan payments from fluctuating due to interest, institutions use loan amortization.Īmortization takes into account the total amount you'll owe when all interest has been calculated, then creates a standard monthly payment. Basically, the less principal you still owe, the smaller your interest is going to end up being. The amount of interest you pay on the borrowed money, or principal, changes as you pay back the money.

When you get a loan from a bank or a private financial institution, you have to pay interest back on the money you borrow. You can also take advantage of amortization to save money and pay off your loan faster. Loan amortization doesn't just standardize your payments. Your loan may have a fixed time period and a specific interest rate, but that doesn't mean you're locked into making the same payment every month for decades. How to Accelerate Repayment with Loan Amortization

0 kommentar(er)

0 kommentar(er)